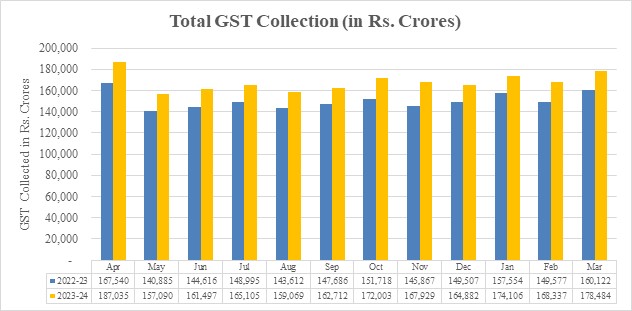

Gross Good and Services Tax (GST) revenue for March 2024 witnessed the second highest collection ever at ₹1.78 lakh crore, with a 11.5% year-on-year growth. This surge was driven by a significant rise in GST collection from domestic transactions at 17.6%. GST revenue net of refunds for March 2024 is ₹1.65 lakh crore which is growth of 18.4% over same period last year.

Strong Consistent Performance in FY 2023-24: FY 2023-24 marks a milestone with total gross GST collection of Rs. 20.14 lakh crore exceeding ₹20 lakh crore, a 11.7% increase compared to the previous year. The average monthly collection for this fiscal year stands at ₹1.68 lakh crore, surpassing the previous year’s average of ₹1.5 lakh crore. GST revenue net of refunds as of March 2024 for the current fiscal year is ₹18.01 lakh crore which is a growth of 13.4% over same period last year.

Positive Performance Across Components:

Breakdown of March 2024 Collections:

- Central Goods and Services Tax (CGST): ₹34,532 crore;

- State Goods and Services Tax (SGST): ₹43,746 crore;

- Integrated Goods and Services Tax (IGST): ₹87,947 crore, including ₹40,322 crore collected on imported goods;

- Cess: ₹12,259 crore, including ₹996 crore collected on imported goods.

Similar positive trends are observed in the entire FY 2023-24 collections:

- Central Goods and Services Tax (CGST): ₹3,75,710 crore;

- State Goods and Services Tax (SGST): ₹4,71,195 crore;

- Integrated Goods and Services Tax (IGST): ₹10,26,790 crore, including ₹4,83,086 crore collected on imported goods;

- Cess: ₹1,44,554 crore, including ₹11,915 crore collected on imported goods.

Inter-Governmental Settlement: In the month of March, 2024, the Central Government settled ₹43,264 crore to CGST and ₹37,704 crore to SGST from the IGST collected. This translates to a total revenue of ₹77,796 crore for CGST and ₹81,450 crore for SGST for March, 2024 after regular settlement. For the FY 2023-24, the central government settled ₹4,87,039 crore to CGST and ₹4,12,028 crore to SGST from the IGST collected.

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of March, 2024 as compared to March, 2023. Table-2 shows the state-wise figures of post settlement GST revenue of each State till the month of March, 2024.

Chart: Trends in GST Collection

Table 1: State-wise growth of GST Revenues during March, 2024[1]

| State/UT | Mar-23 | Mar-24 | Growth (%) |

| Jammu and Kashmir | 477 | 601 | 26% |

| Himachal Pradesh | 739 | 852 | 15% |

| Punjab | 1,735 | 2,090 | 20% |

| Chandigarh | 202 | 238 | 18% |

| Uttarakhand | 1,523 | 1,730 | 14% |

| Haryana | 7,780 | 9,545 | 23% |

| Delhi | 4,840 | 5,820 | 20% |

| Rajasthan | 4,154 | 4,798 | 15% |

| Uttar Pradesh | 7,613 | 9,087 | 19% |

| Bihar | 1,744 | 1,991 | 14% |

| Sikkim | 262 | 303 | 16% |

| Arunachal Pradesh | 144 | 168 | 16% |

| Nagaland | 58 | 83 | 43% |

| Manipur | 65 | 69 | 6% |

| Mizoram | 70 | 50 | -29% |

| Tripura | 90 | 121 | 34% |

| Meghalaya | 202 | 213 | 6% |

| Assam | 1,280 | 1,543 | 21% |

| West Bengal | 5,092 | 5,473 | 7% |

| Jharkhand | 3,083 | 3,243 | 5% |

| Odisha | 4,749 | 5,109 | 8% |

| Chhattisgarh | 3,017 | 3,143 | 4% |

| Madhya Pradesh | 3,346 | 3,974 | 19% |

| Gujarat | 9,919 | 11,392 | 15% |

| Dadra and Nagar Haveli and Daman & Diu | 309 | 452 | 46% |

| Maharashtra | 22,695 | 27,688 | 22% |

| Karnataka | 10,360 | 13,014 | 26% |

| Goa | 515 | 565 | 10% |

| Lakshadweep | 3 | 2 | -18% |

| Kerala | 2,354 | 2,598 | 10% |

| Tamil Nadu | 9,245 | 11,017 | 19% |

| Puducherry | 204 | 221 | 9% |

| Andaman and Nicobar Islands | 37 | 32 | -14% |

| Telangana | 4,804 | 5,399 | 12% |

| Andhra Pradesh | 3,532 | 4,082 | 16% |

| Ladakh | 23 | 41 | 82% |

| Other Territory | 249 | 196 | -21% |

| Center Jurisdiction | 142 | 220 | 55% |

| Grand Total | 1,16,659 | 1,37,166 | 18% |

Table-2: SGST & SGST portion of IGST settled to States/UTs April-March (Rs. in crore)

| Pre-Settlement SGST | Post-Settlement SGST[2] | |||||

| State/UT | 2022-23 | 2023-24 | Growth | 2022-23 | 2023-24 | Growth |

| Jammu and Kashmir | 2,350 | 2,945 | 25% | 7,272 | 8,093 | 11% |

| Himachal Pradesh | 2,346 | 2,597 | 11% | 5,543 | 5,584 | 1% |

| Punjab | 7,660 | 8,406 | 10% | 19,422 | 22,106 | 14% |

| Chandigarh | 629 | 689 | 10% | 2,124 | 2,314 | 9% |

| Uttarakhand | 4,787 | 5,415 | 13% | 7,554 | 8,403 | 11% |

| Haryana | 18,143 | 20,334 | 12% | 30,952 | 34,901 | 13% |

| Delhi | 13,619 | 15,647 | 15% | 28,284 | 32,165 | 14% |

| Rajasthan | 15,636 | 17,531 | 12% | 35,014 | 39,140 | 12% |

| Uttar Pradesh | 27,366 | 32,534 | 19% | 66,052 | 76,649 | 16% |

| Bihar | 7,543 | 8,535 | 13% | 23,384 | 27,622 | 18% |

| Sikkim | 301 | 420 | 39% | 839 | 951 | 13% |

| Arunachal Pradesh | 494 | 628 | 27% | 1,623 | 1,902 | 17% |

| Nagaland | 228 | 307 | 35% | 964 | 1,057 | 10% |

| Manipur | 321 | 346 | 8% | 1,439 | 1,095 | -24% |

| Mizoram | 230 | 273 | 19% | 892 | 963 | 8% |

| Tripura | 435 | 512 | 18% | 1,463 | 1,583 | 8% |

| Meghalaya | 489 | 607 | 24% | 1,490 | 1,713 | 15% |

| Assam | 5,180 | 6,010 | 16% | 12,639 | 14,691 | 16% |

| West Bengal | 21,514 | 23,436 | 9% | 39,052 | 41,976 | 7% |

| Jharkhand | 7,813 | 8,840 | 13% | 11,490 | 12,456 | 8% |

| Odisha | 14,211 | 16,455 | 16% | 19,613 | 24,942 | 27% |

| Chhattisgarh | 7,489 | 8,175 | 9% | 11,417 | 13,895 | 22% |

| Madhya Pradesh | 10,937 | 13,072 | 20% | 27,825 | 33,800 | 21% |

| Gujarat | 37,802 | 42,371 | 12% | 58,009 | 64,002 | 10% |

| Dadra and Nagar Haveli and Daman and Diu | 637 | 661 | 4% | 1,183 | 1,083 | -8% |

| Maharashtra | 85,532 | 1,00,843 | 18% | 1,29,129 | 1,49,115 | 15% |

| Karnataka | 35,429 | 40,969 | 16% | 65,579 | 75,187 | 15% |

| Goa | 2,018 | 2,352 | 17% | 3,593 | 4,120 | 15% |

| Lakshadweep | 10 | 19 | 93% | 47 | 82 | 75% |

| Kerala | 12,311 | 13,967 | 13% | 29,188 | 30,873 | 6% |

| Tamil Nadu | 36,353 | 41,082 | 13% | 58,194 | 65,834 | 13% |

| Puducherry | 463 | 509 | 10% | 1,161 | 1,366 | 18% |

| Andaman and Nicobar Islands | 183 | 206 | 12% | 484 | 528 | 9% |

| Telangana | 16,877 | 20,012 | 19% | 38,008 | 40,650 | 7% |

| Andhra Pradesh | 12,542 | 14,008 | 12% | 28,589 | 31,606 | 11% |

| Ladakh | 171 | 250 | 46% | 517 | 653 | 26% |

| Other Territory | 201 | 231 | 15% | 721 | 1,123 | 56% |

| Grand Total | 4,10,251 | 4,71,195 | 15% | 7,70,747 | 8,74,223 | 13% |

[1]Does not include GST on import of goods

[2] Post-Settlement GST is cumulative of the GST revenues of the States/UTs and the SGST portion of the IGST settled to the States/UTs