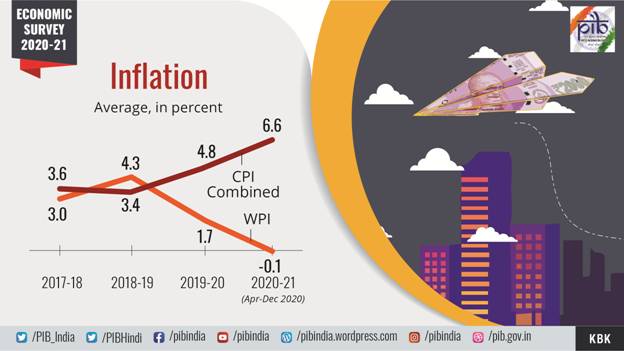

The Economic Survey 2020-21 says that going forward, as food inflation eases further, overall inflation is expected to moderate. It says that easing of supply side restrictions, which saw inflation moderate in December 2020, are expected to continue this easing. The Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman presented the Economic Survey 2020-21 in Parliament today.

The Survey states that during 2020-21, retail and wholesale inflation saw movements in the opposite directions, with the headline CPI-combined (C) increasing, compared to the previous year, while the WPI inflation remained benign. Overall, headline CPI inflation remained high during the COVID-19 induced lockdown period and subsequently, due to the persistence of supply side disruptions. The rise in inflation was mostly driven by food inflation, which increased to 9.1 per cent during 2020-21 (Apr-Dec). Due to COVID-19 induced disruptions, an overall increase in the price momentum is witnessed, driving inflation since April 2020, whereas positive base effect has been a moderating factor. The difference in rural-urban CPI inflation, which was high in 2019, saw a decline from November 2019 that continued in 2020. Inflation ranged between 3.2 per cent to 11 per cent across States/UTs in 2020-21 (Jun-Dec) compared to (-) 0.3 per cent to 7.6 per cent in the same period last year. Thali prices for both vegetarian and non-vegetarian Thalis declined significantly in January-March 2020, before rising sharply during April to November in both rural and urban areas before easing in December 2020. The easing in CPI-C is expected to ease Thali prices going forward.

The Survey says that supply side shocks, especially owing to the Covid-19 pandemic affected the retail inflation, with food articles contributing to the overall rise in inflation. Food inflation has already eased in December, reducing overall inflationary pressures. On the other hand, improving demand conditions are likely to keep WPI inflation in the positive territory, with improving pricing power for manufacturers. It notes that steps were taken to stabilise prices of food items like banning of export of onions, imposition of stock limit on onions, easing of restriction on imports of pulses etc.

Mentioning about measures to control undue price rise, the Survey states that Price Stabilization Fund (PSF) Scheme is being efficiently implemented and has succeeded in achieving its objective of stabilizing prices of pulses and offered significant benefits to all stakeholders. Government has taken a decision that all Ministries/Department having schemes with nutrition component or providing food/catering/hospitality services would utilize pulses from the central buffer. Creation of buffer stock of pulses has helped in moderating pulses prices and lower prices of pulses lead to consumer savings. States/UTs area slso being encouraged to set up their own State level PSF. Pulses from the PSF buffer are also being utilized for free supplies under PMGKAY and ANB package. Government of India maintains buffer stocks of onion under PSF for making appropriate price stabilizing market interventions.

The Survey suggests that apart from the short-term measures to curtail the upward price movement, we need to invest in medium to long-term measures such as decentralised cold storage facilities at production centres. Good storer varieties, judicious use of fertilizers, timely irrigation and post-harvest technology are essential to reduce the losses in stored onions (Operation Greens portal). Review of onion buffer stock policy is also essential. System needs to be developed to reduce wastages, efficient management and ensure timely release.

It advises that consistency in import policy also warrants attention. Increased dependence on imports of edible oils poses risk of fluctuations in import prices and imports, impacting production and prices of domestic edible oil market, coupled with frequent changes in import policy of pulses and edible oils adds to confusion among farmers/producers and delay in imports.

The Survey finds that sole focus on CPI-C inflation may not be appropriate for four reasons. First, food inflation, which contributes significantly to CPI-C, is driven primarily by supply-side factors. Second, given its role as the headline target for monetary policy, changes in CPI-C anchor inflation expectations. This occurs despite inflation in CPI-C being driven by supply-side factors that drive food inflation. Third, several components of food inflation are transitory, with wide variations within the food and beverages group. Finally, food inflation has been driving overall CPI-C inflation due to the relatively higher weight of food items in the index. While food habits have undergone revisions over the decade since 2011-12, which is base year of CPI, the same is not reflected in the index yet. The base year of CPI therefore needs to be revised to overcome the measurement error that may be arising from the change in food habits. For all these reasons, a greater focus on core inflation is warranted.

The Survey further states that given the significant increase in e-commerce transactions, new sources of price data capturing e-commerce transactions must get incorporated in the construction of price indices. During the year, the government took several measures to make crucial drugs for COVID-19 treatment available at affordable prices, to stabilise prices of sensitive food items like banning of export of onions, imposition of stock limit on onions, easing of restriction on imports of pulses etc. However, consistency in import policy of sensitive food items warrants attention as frequent changes in import policy of pulses and edible oils adds to confusion and delays. To rein in the vegetable inflation, review of relevant buffer stock policies is essential. To avoid supply-side disruptions that cause inflation seasonality in vegetables, food, CPI-C and in inflation expectations, a system needs to be developed to reduce wastages and ensure timely release of stock.